The Measure of Earnings – Business Valuation

What is a Business Valuation?

A business valuation is a formal report which assesses (among other things) the future cashflow of the business, goodwill, and intellectual property to arrive at a dollar value of what the business is worth at that point in time. As part of the valuation process, we are forced to make a number of general assumptions – one such assumption is that the historical financial performance is an indicator of future financial performance.

What Are Common Business Valuation Adjustments?

Although we assume that historical financial performance is an accurate indication of future financial performance, in order to assess a business’s true earnings other adjustments are needed. We make these further adjustments after considering (among other things) the following items:

- Abnormal Income/Expenses (Waste removal, legal fees which could be once-off).

- Non-commercial expenses (Cars owned by the business but used by the owners for other purposes).

- Related party transactions that could include items such as management fees, consulting fees, or directors’ drawings.

The most common adjustment we make is wages. Owners typically do not pay themselves a fair wage, instead electing to draw on a director loan, to help drive up the businesses value and profitably. In this instance, we would assess a fair market salary for a director.

The Measure of Earnings Explained

Although financial adjustments are crucial in a business valuation, consideration for the best measure of earnings is critical in determining the businesses value. Below I outline the various types of measures of earnings:

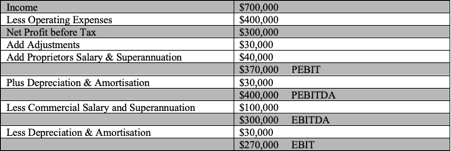

PEBIT

PEBIT is an acronym for Proprietors Earnings Before Interest and Tax.

This process determines what a business should return in total earnings to one working proprietor, including both wages and superannuation after applying adjustments.

A good example of a business that would be suited to PEBIT as a measure of earnings is a small trucking business operated by an owner-driver, earning under $1 million.

PEBITDA

PEBITDA is an acronym for Proprietors Earnings Before Interest, Tax, Depreciation, and Amortisation.

PEBITA, like PEBIT, is used in circumstances where there is limited need to update the physical assets of a business.

A good example of a business that would be suited to a PEBITDA as a measure of earnings is a Recruitment/Consultancy business that operates out of a small office with minimal assets.

EBITDA

EBITDA is an acronym for Earnings Before Interest, Tax, Depreciation, and Amortisation.

Although similar to PEBITDA, EBITDA’s difference is that the measure of earnings includes a market salary expense of the working proprietor.

A great example of where EBITDA is applicable would be a medium-sized Law Firm turning over $1,000,000.

EBIT

EBIT is an acronym for Earnings Before Interest and Tax.

Although similar to PEBIT, EBIT’s difference is that the measure of earnings includes a market salary expense of the working proprietor.

This measure of earnings is applicable to a large business that has a large asset base. The asset base would be integral to their day to day performance of the business.

A great example would be a trucking business that has a large fleet of trucks that needs to be updated periodically.

In consideration of the above, below is a hypothetical profit and loss statement in considering the measure of earnings:

Should you require more information about a business valuation, please do not hesitate to contact me on admin@assetvaluations.com.au.

Leave a Reply

Want to join the discussion?Feel free to contribute!